Oregon 529 Tax Deduction 2025. As part of the secure 2.0 act of 2025, 529 plan account holders are now allowed to roll over up to $35,000 in unused funds into a roth ira, and that could help. Tax deductions are amounts that reduce your taxable income for the year.

As parents, grandparents and students, we know college is coming and that we’re somehow going to have to pay for it. Although there’s no federal tax deduction for 529 contributions, most states offer some kind of tax break or other incentive to contribute to their college.

And anyone who makes contributions can earn an income tax credit worth $170 for single filers or $340 for.

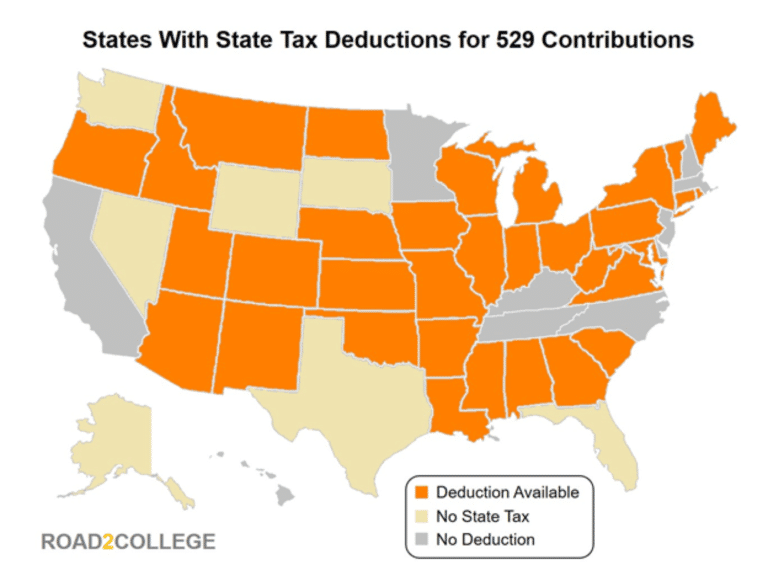

Map of 529 State Tax Deductions Road2College, The credit replaces the current tax deduction on january 1, 2025. By springwater wealth | apr 29, 2025.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Oregon state income tax calculation: As parents, grandparents and students, we know college is coming and that we're somehow going to have to pay for it.

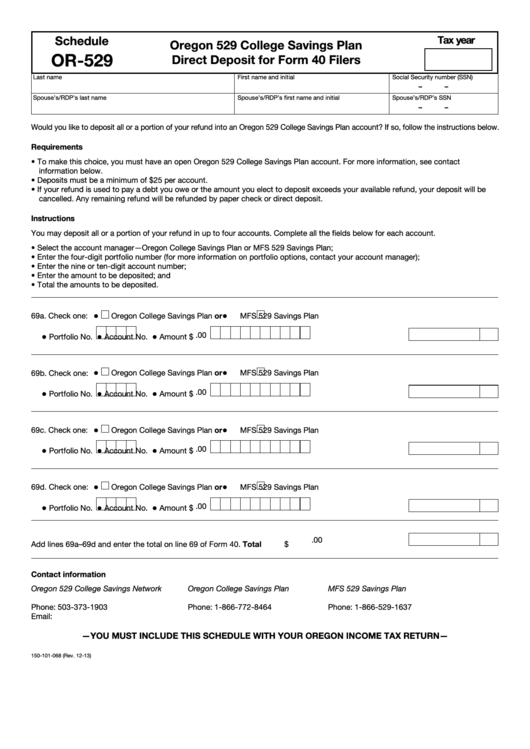

Fillable Schedule Or529 Oregon 529 College Savings Plan Direct, The lifetime limit for the rollover is $35,000 per beneficiary. The credit replaces the current tax deduction on january 1, 2025.

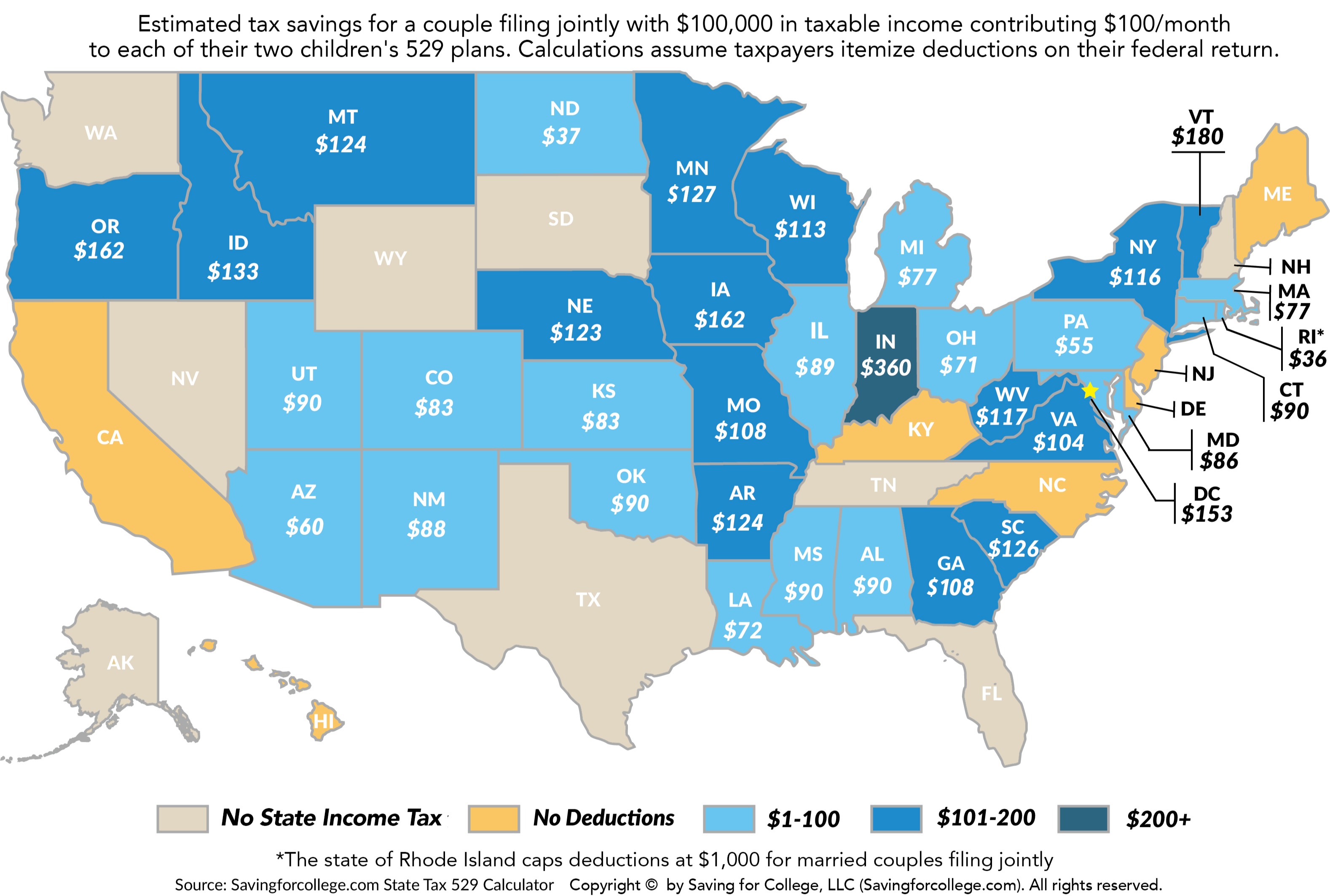

How Much Is Your State's 529 Plan Tax Deduction Really Worth?, No additional benefits like scholarship options. I am trying to file 2025 taxes and have a 529 with the oregon college savings program.

How Much Is Your State's 529 Plan Tax Deduction Really Worth?, Get connected with a financial advisor near you to learn more. And anyone who makes contributions can earn an income tax credit worth $170 for single filers or $340 for.

529 Tax Deduction, And anyone who makes contributions can earn an income tax credit worth $170 for single filers or $340 for. As part of the secure 2.0 act of 2025, 529 plan account holders are now allowed to roll over up to $35,000 in unused funds into a roth ira, and that could help.

529 College Savings Plans All 50 States Tax Benefit Comparison, Understanding 529 plan tax deductions. The standard deduction for a single filer in oregon for 2025 is $ 2,745.00.

What is the Right 529 Plan for College Savings? Merriman, A recent change to tax law will. Understanding 529 plan tax deductions.

50 Unbelievable Benefits of a 529 Plan Ultimate Guide 2025, If you make $70,000 a year living in minnesota you will be taxed $11,136. By springwater wealth | apr 29, 2025.

Understanding state tax deductions Scholars Choice Nuveen, The credit replaces the current tax deduction on january 1, 2025. The lifetime limit for the rollover is $35,000 per beneficiary.

Rock Concerts In Chicago 2025. Find tickets to all live music, concerts, tour dates and festivals in and around chicago....

Iptv Player 2025. With firestick as your portal, indulge in a diverse array of content, from sports and movies to...

Kennedy Space Centre Launches 2025. This year, officials expect florida's space coast — home of nasa's kennedy space center and...

Apa World Pool Championships 2025. The american poolplayers association (apa) is the world’s largest amateur pool league. 608 likes ·...

Vanderpump Rules Reunion 2025 Full Episode. The 2025 cast is set heading into the. Streaming next day on peacock. The...

Nina Dobrev Convention 2025. I was feeling epic convention december 2025. Actress nina dobrev attends the 2025 vanity fair oscar...